“Landing an accounting gig won’t magically make you more organized,” Allec says. “If you want to be an organizational master when embarking on your accounting career, you’ll need to start working on organizing your life and responsibilities now.” “Working on different projects and being able to manage deadlines is a trait that separates passable accountants from their top-shelf peers,” he says. Bryant adds that this attribute is particularly valuable during tax season when many accountants are overloaded with clients and bound to inflexible deadlines. Accountants constantly encounter errors, discrepancies, and inaccuracies.

Step 1. Create your chart of accounts

In this post, we share an example of an accountant job description summary, followed by responsibilities, requirements, and skills. After the Great Depression and the formation of the Securities and Exchange Commission (SEC), all publicly traded companies were required to issue reports written by accredited accountants. Today, accountants remain a ubiquitous and crucial part of any business. Certification requirements vary, with some roles requiring additional educational requirements above the bachelor’s degree and successful completion of rigorous examinations. The most common are the certified internal auditor (CIA), certified management accountant (CMA), and certified public accountant (CPA). An accountant reviews and analyses financial records, keeping track of a company’s or individual’s income, expenditures, and tax liabilities.

Do you already work with a financial advisor?

Blue Dot uses patented technology to analyze expense reports and invoices to identify recoverable VAT amounts. It can ensure GDPR & SOC 2 Type II compliance with local tax regulations and generate reports for filing. This saves time and, more importantly, minimizes the risk of mistakes that could lead to penalties. Zeni AI combines AI technology with financial experts to provide more comprehensive services.

Accountant responsibilities

However, there are drawbacks as well, such as the cost of services, dependence on the accountant’s expertise and integrity, and the potential for human errors. Despite their expertise, accountants are humans and can make errors, leading to financial losses or regulatory issues. Having an accountant ensures a business stays compliant with the various regulations, saving the company from penalties and maintaining its reputation. An accountant is a critical cog in the financial machinery of any business, small or large.

These tools speed up report generation, tax filing, and payment management. With this software handling rote work, accountants can focus on their most important tasks. Whether you run a small business or an enterprise, accounting plays a key role in financial management. With accounting skills, you can set a how to scale a business budget, optimize tax returns, or forecast trends. Still, even after learning what an accountant does, you might still wonder what accounting is at its core. Accountant responsibilities include auditing financial documents and procedures, reconciling bank statements and calculating tax payments and returns.

Bookkeepers or accountants are often responsible for recording these transactions during the accounting cycle. There’s no doubt that the accounting profession has experienced significant change in recent years. While the changes have unlocked a number of growth opportunities, they have also resulted in challenges and issues that today’s firms need to have on their radars. However, there are several important developments to be aware of as the industry continues to evolve.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Hiring an accountant can be expensive, especially for small businesses or startups operating on a tight budget. Accountants manage risk by conducting internal audits, identifying areas of weakness, and suggesting improvements. Forensic accountants investigate financial crimes such as embezzlement, fraud, and other complex financial disputes.

- Assigning codes organizes accounts payable processing so you know when to expect payments.

- Docyt is an AI-based accounting automation application that simplifies bookkeeping and streamlines financial workflows.

- Knowledge of how to prepare and report on financial statements is critical to becoming an accountant.

- Find and compare business software insights to increase efficiency, streamline operations, enhance collaboration, reduce costs, and grow your business.

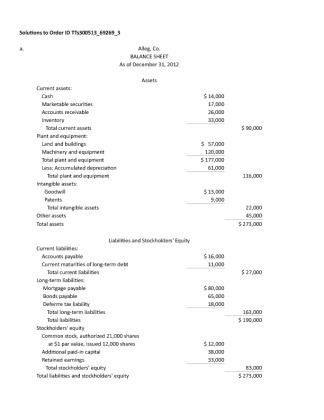

It is important to set proper procedures for each of the eight steps in the process to create checks and balances to catch unwanted errors. Before you create your financial statements, you need to make adjustments to account for any corrections for accruals or deferrals. If you have debits and credits that don’t balance, you have to review the entries and adjust accordingly. As a small business owner, it’s essential to have a clear picture of your company’s financial health. Transactional accounting is the process of recording the money coming in and going out of a business—its transactions. To stay competitive in today’s ever-changing regulatory environment, firms must have the ability to quickly and efficiently conduct tax research and improve tax reporting efficiencies.

An example of an adjustment is a salary or bill paid later in the accounting period. Because it was recorded as accounts payable when the cost originally occurred, it requires an adjustment to remove the charge. Bookkeeping can be a daunting task, even for the most seasoned business owners.

To be successful in this role, you should have previous experience with bookkeeping and a flair for spotting numerical mistakes. From checking your financial data daily to preparing year-end financial statements, healthy accounting practices make life easier. When you know your financial tracks are covered, you can focus on the exciting aspects of running your business and bringing new ideas to life. Get into the habit of reviewing your accounting checklists regularly so nothing catches you by surprise later.

BILL saves time by reducing manual data entry, minimizing errors, and learning from every invoice processed to improve accuracy. Users can easily review information and approve payments with a single click. It offers real-time invoice tracking, allowing users to easily see the status of their invoices at a glance – viewed, outstanding, or paid. Understanding daily transactions are crucial to help you track how much cash your company has and how much it owes to others.

Entering inventory into your system the same day you receive it keeps your system current, giving you a more accurate look at your stock. Without this level of inventory management, your staff may lose sales by telling customers you’re out of stock when an item just hasn’t been entered into the system. Also, if your staff sells out of an item, reordering may be delayed if your system isn’t set up to allow negative inventory counts. Reconciling cash and receipts at the end of each day helps you quickly discover cash shortages or overages. You can then determine where the money went and identify errors, employee fraud or theft.

GAAP is a set of standards and principles designed to improve the comparability and consistency of financial reporting across industries. Analysts, managers, business owners, and accountants use this information to determine what their products should cost. In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, how to account for outstanding checks in a journal entry money is considered to be a measure of a company’s economic performance. For example, they might recommend an online payroll service to cut overhead costs. As a trusted advisor in an increasingly complex financial landscape, certified public accountants (CPAs) have significant responsibilities for the services they provide to their clients.

Financial statements generated through financial accounting are used by many parties outside of a company, including lenders, government agencies, auditors, insurance agencies, and investors. An income statement can be useful to management, but managerial accounting gives a company better insight into production and pricing strategies compared with financial accounting. In most cases, accountants use generally accepted accounting principles (GAAP) when preparing financial statements in the U.S.

Accountants may be tasked with recording specific transactions or working with specific sets of information. For this reason, there are several broad groups that most accountants can be grouped into. The Alliance for Responsible Professional Licensing (ARPL) was formed in August 2019 in response government contracting 101 to a series of state deregulatory proposals making the requirements to become a CPA more lenient. The ARPL is a coalition of various advanced professional groups including engineers, accountants, and architects. The history of accounting has been around almost as long as money itself.